Is a repaid loan a debit or credit balance?

A loan can be considered as a debit balance when the loan is given out by the business while it can be considered as a credit balance when it is taken by the business.

When you're entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash. Your lender's records should match your liability account in Loan Payable.

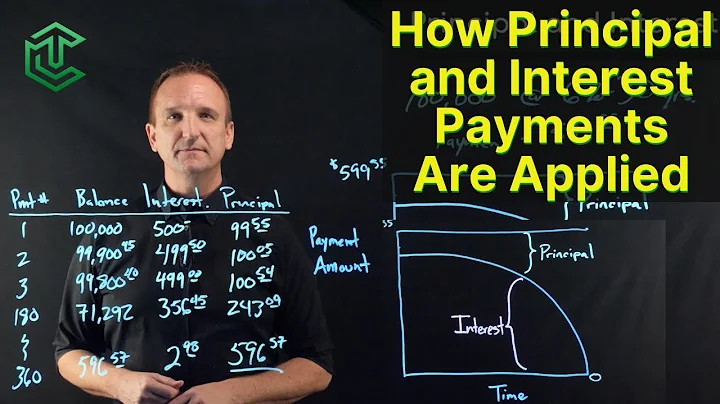

Repayment refers to paying back money that you have borrowed. Loan repayments cover a part of the principal, or the amount borrowed, and interest, which is what the lender charges for supplying the funds. Loan agreements specify the repayment terms, including the interest rates to be paid.

If the loan is something you owe, it's a credit on your personal balance sheet. But the same loan is an asset for the bank, because its someing owed to them. So for banks, loans are debits.

In the standard presentation for the debtor, a debit entry is recorded under the appropriate instrument representing the repayment of the old debt with a credit entry under the appropriate instrument representing the creation of a new debt (Table A1.

If you're recording periodic loan payments, you'll start by applying the payment toward the interest expense. You'll then debit the remaining amount to the loan account. This will result in a reduction of the balance you have outstanding, and then the cash account will be credited to record the cash payment.

Answer and Explanation: Loan repayments make the company suffer some costs to cater for the interest fees; therefore, expenses in the company increase, which are part of the losses in the company. Therefore, additions are made on the losses side in profit and loss statements when there are loan repayments.

Check your updated credit history

From time to time, credit bureaus update a borrower's credit records. The fact that you have repaid your home loan should start reflecting in your credit history, soon after the bank issues the no-dues certificate along with a no-encumbrance certificate.

What's the difference between repayment and payment? "Payment" refers to a singular amount. "Repayment" refers to a situation. "My loan is in repayment." This means that you are currently paying back money that you borrowed.

A bullet repayment is a lump sum payment made for the entirety of an outstanding loan amount, usually at maturity. It can also be a single payment of principal on a bond. In terms of banking and real estate, loans with bullet repayments are also referred to as balloon loans.

Is a loan debt or credit?

Credit is the loan that your lender provides to you. It is the money you borrow up to the limit the lender sets. That is the maximum amount you can borrow. Debt is the amount you owe and must pay back with interest and all fees.

Example of a Credit Balance

Bank Account: Jane has a checking account with her local bank. After depositing her paycheck, her account balance is $2,000. This is a credit balance, representing the amount of money Jane has available to spend or withdraw.

an amount of money in a bank account, etc. which is less than zero because more money was taken out of it than the total amount that was paid into it: Customers should consider transferring the debit balance to a credit card with a special rate for debt transfers. Compare.

Loan account is debited while repayment of a bank loan.

Credit is a term used to mean "what is owed," and debit is "what is due." Understanding how to use CR and DR will help you make sense of a company's balance sheet and gain useful insight into the increases and decreases of key accounts.

Is a Loan Payment an Expense? Partially. Only the interest portion on a loan payment is considered to be an expense. The principal paid is a reduction of a company's “loans payable”, and will be reported by management as cash outflow on the Statement of Cash Flow.

- Go to the Accounting tab on the left side, then choose Chart of Accounts.

- Click the New button.

- In the Account Type drop-down, pick either Long Term Liabilities or Current Liabilities (pay off by the end of the current fiscal year).

- Select Loan Payable in the Detail Type field.

A loan payable is a liability on a company's balance sheet that represents the amounts the company owes to lenders as a result of borrowing money. The loan is categorized as a payable because it represents an obligation that the company has to pay in the future.

In the Profit and Loss

The Profit and Loss statement will only display the interest you pay on your loans, not the principal. This is because the interest is the only portion of the loan payment that is expensable, meaning it will affect your net profit. Your total interest can be seen in the Interest Expense line.

The full amount of your loan should be recorded as a liability on your business's balance sheet. Two liability accounts should be set up: one for short-term and one for long-term. The offset is either an increase to cash or the recording of new assets like a car, truck, or building.

Is loan repayment an operating expense?

Interest – only the interest portion of loan repayments are counted as an expense. The principal is not an operating expense. Principal repayments are recorded as a finance expense.

While paying off your debts often helps improve your credit scores, this isn't always the case. It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt.

Repayment of a loan means paying back the amount taken from the lender. This paying-back process is done usually via monthly payments over the stipulated period of your loan. It includes paying back the principal amount (the original sum of money borrowed) and the interest charged on it.

- Equated Monthly Instalment (EMI) EMI is the cornerstone of loan repayment in India. ...

- Step-up Repayment. ...

- Step-Down Repayment. ...

- Balloon Repayment. ...

- Bullet Repayment. ...

- Flexible Loan Repayment. ...

- Overdraft Facility. ...

- Prepayment and Foreclosure.

(rɪpeɪ ) verb. If you repay a loan or a debt, you pay back the money that you owe to the person who you borrowed or took it from.