Does supplies increase with debit or credit?

In general, when supplies are purchased, they are recorded as an expense on the balance sheet which means that they will be debited. The corresponding entry will be credited against cash or accounts payable depending on how the purchase was made.

Supplies are an asset account with a normal debit balance. Thus, a credit is required to decrease the balance. Equipment is an asset.

Debits increase asset, loss and expense accounts; credits decrease them. Credits increase liability, equity, gains and revenue accounts; debits decrease them.

The account is debited when payments are made to suppliers and other creditors. In other words, when money is owed to a supplier or creditor, the Accounts Payable account is debited, and when money is paid to a supplier or creditor, the Accounts Payable account is credited.

Merchandise inventory (also called Inventory) is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease.

Explanation: Sales Revenue forms part of equity accounts and a credit to sales revenue represents an increase in sales revenue. Option (a) Supplies Expense is not the correct answer since expense accounts have a normal debit balance. Crediting supplies expense will result in a decrease in supplies expense.

Answer and Explanation: Correct Answer: Option (C) Is increased with a debit entry is the correct answer because as the supply expenses debited then the balance of supply expenses increases.

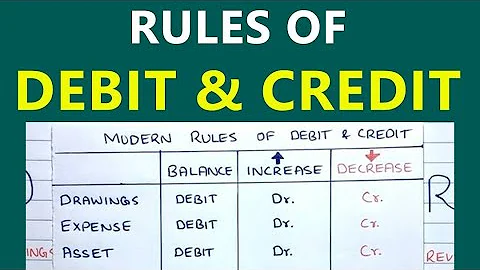

+ + Rules of Debits and Credits: Assets are increased by debits and decreased by credits. Liabilities are increased by credits and decreased by debits. Equity accounts are increased by credits and decreased by debits. Revenues are increased by credits and decreased by debits.

Accounts increased by debits A debit will increase the following types of accounts: Assets (Cash, Accounts receivable, Inventory, Land, Equipment, etc.) Expenses (Rent Expense, Wages Expense, Interest Expense, etc.)

- First: Debit what comes in, Credit what goes out.

- Second: Debit all expenses and losses, Credit all incomes and gains.

- Third: Debit the receiver, Credit the giver.

Is supplies a debit balance?

The supplies account is an asset account and has a normal debit balance.

Supplies can be considered a current asset if their dollar value is significant. If the cost is significant, small businesses can record the amount of unused supplies on their balance sheet in the asset account under Supplies.

A supplier debit is money that a supplier owes you. To process a supplier debit, you first need to record a debit transaction and then record the settlement of the debit (for example, by recording a refund cheque from your supplier).

When supplies are used: The cost of the supplies is recognized as an expense when they are used. This is done by debiting (increasing) the supplies expense account and crediting (decreasing) the supplies asset account.

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

The Bottom Line. A debit is an accounting entry that creates a decrease in liabilities or an increase in assets.

Supply of goods and services

An increase in price almost always leads to an increase in the quantity supplied of that good or service, while a decrease in price will decrease the quantity supplied.

On the other hand, a credit (CR) is an entry made on the right side of an account. It either increases equity, liability, or revenue accounts or decreases an asset or expense account (aka the opposite of a debit).

For instance, if a company purchases supplies on credit, it increases its Accounts Payable—a liability account—by crediting it. When the company later pays off this payable, it reduces the liability by debiting Accounts Payable. Assets and liabilities are on the opposite side of the accounting equation.

The debit to supplies expense account is necessary because the supplies are consumed during the period, so they must be expensed. Expenses are not paid with cash, but rather recorded in journal entries. If we credit cash, then both assets and expenses will increase by $500.

What is the rule of debit and credit?

Before we analyse further, we should know the three renowned brilliant principles of bookkeeping: Firstly: Debit what comes in and credit what goes out. Secondly: Debit all expenses and credit all incomes and gains. Thirdly: Debit the Receiver, Credit the giver.

Debit does not always mean increase and credit does not always mean decrease. It depends upon the accounts involved.

Debit represents the left side of an account and denotes an increase in assets and expenses or a decrease in liabilities and equity. Credit represents the right side of an account and denotes an increase in liabilities and equity or a decrease in assets and expenses.

An increase in the value of assets is a debit to the account, and a decrease is a credit. On the flip side, an increase in liabilities or shareholders' equity is a credit to the account, notated as "CR," and a decrease is a debit, notated as "DR."

Assets are the rights of the company and have a debit balance. As the rule says, debit what comes in and debit the receiver. So, a debit in the account increases its balance. Equity and liabilities are obligations of the company and have a credit balance.